The Emerging Franchise Brand

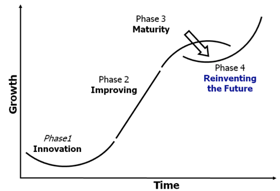

Every superstar franchise starts as a “new brand”. A big reason why emerging franchises and brands are created is due to market demand. Every business is born, it evolves and matures as the market evolves and changes or it reaches a point of diminishing returns and dies. An emerging brand is not necessarily a new product or service. it may be an improved product or new service. or a new way of taking advantage of technology to better deliver a commodity product or service.

If you’re not risk adverse, evaluating an emerging franchise may be to your benefit. Just like any new franchisee that is investing their life’s savings into a business, a new franchisor is likely doing the same. Emerging franchisors may be less adverse to negotiating some of the terms of their franchise agreement. Some of the areas where negotiations frequently take place are in the initial franchise fee, royalty, territorial rights, training, terms of the development agreement, personal guarantees, etc.

However, emerging brands are not for everyone. On one side of the equation the investment risk is higher, there still may be some kinks in the operational model that have to be worked out, harder to validate because there is little or no historical data, etc.

When to get in, When to get out, When to walk away.

There are lessons to be learned of franchisors that flew towards the sun and then quickly fell to earth. The story that has always been my tale of business Icarus is that of Blockbuster Entertainment.

Blockbuster as an emerging brand in 1987 was genius; at its peak in 2004 there were more than 9,100 locations across the US. Lets’s imagine you invested in this emerging brand at its inception in 1987, by 2000 you were part of a $5 billion franchise. Your friends and family hail your investment as pure genius and seek your advice and council.

By 2004 Blockbuster. perhaps blinded or over confident by its $5 billion IPO a few years earlier, failed to see the market shift and react to consumer demand to mail-order DVD, emerging broadband internet which would bring about VOD (video-on-demand) and streaming.

Blockbuster missed the turn-off and by 2004 were in skid from which they would never recover. Having passed on the acquisition of Netflix in 2000. By the time Blockbuster finally got into the mail DVD market in 2004, Netflix had already grown to $270 million in revenue and 1 million subscribers. Today, Blockbuster is just a cautionary tale of a franchisor not plugged into the market forces and customer demand and failing in reinventing its future.

Just Lucky

In 2001 I was ready to invest in a franchise in a video and music rental and trading franchise. The financial performance (Item 19) in the FDD looked great. Loan approved, ready to go. What happened next was just lucky. During a lunch conversation with a colleague, I worked in technology back then, we were chatting about Napster and Limewire (you might remember these somewhat fringe music sharing websites) and where the market was going. He talked about how the major players were really moving rather quickly on monetizing digital content for consumers and the rapid advance of broadband and longer term strategy to stream music and video directly to consumers. Lunch was over for me!

One call to the franchisor and I quickly realized the company had no strategy or contingency for the upcoming market shift. I was lucky, had technology not been my profession I may not have had that conversation and I would have lost a significant investment in an emerging brand on the wrong end of the S- Curve.

Final Thought

There can be major benefits from joining an emerging brand, Just as investing in the stock market at the right time can produce exceptional gains. Did you buy Netflix at $15 per share? Netflix’s gains since from its IPO to 2016 are about 8,000%.

Here are some questions for investors to consider as part of their due diligence in selecting an emerging brand:

- Is the business a fad, a trend or a paradigm shift

- Is the franchise product or service truly “reinventing the future” or just adding a brand to a saturated market place?

- What is the franchisor’s experience and how well have they mastered the challenge of opening, guiding, and managing additional units?

- Does the management team have the foresight, strategy and ability to execute as the lifecycle of the market evolves?

- What is your business plan and exit strategy?

Investing in an emerging brand provides an investor with a ground floor opportunity to help shape and grow the franchisor. It requires a little more entrepreneurial spirit, a little more fortitude to deal with the financial risk, a little more research and preparation. When it comes to selecting an emerging brand you must do a little more research to understand the market forces and and the strategy of the franchisor and its ability to successfully reinvent itself as the market trajectory changes to successfully select and be part of a successful emerging brand.

www.entrepreneur.com

www.encyclopedia.com

www.yahoo.com/movies/life-after-blockbuster

www.linkedin.com/pulse/blockbuster-busted-part-1-s-curve-analysis-dr-phil-samuel

If you’re ready to get started exploring franchise opportunities click “GET STARTED” complete the form and a Veteran Franchise Adviser will contact you.

GET STARTED |

DOWNLOADS |